Small Business Payroll Basics: Avoiding Costly Mistakes

TL;DR

- The single most costly mistake is Worker Misclassification (treating an employee as a 1099 independent contractor), which triggers immediate liability for back payroll taxes (FICA, FUTA) and severe IRS penalties.

- Tax Compliance requires timely action; missing strict IRS Tax Deposit Deadlines for federal and state withholdings (FICA, FUTA, SUTA) can incur financial penalties ranging from 2% to 15% of the amount due.

- Businesses must adhere to Wage and Hour Laws (FLSA), ensuring correct overtime calculation and avoiding FLSA Status Misclassification, where employees are incorrectly labeled as exempt from overtime pay.

- Foundational Compliance relies on proper initial setup (Federal EIN, state registration in AR/MO) and maintaining meticulous recordkeeping (Form I-9, W-4, W-9) to defend against audits and legal liabilities.

Running a growing business in Northwest Arkansas means juggling many responsibilities. For busy owners in Bentonville, Rogers, and Centerton, managing small business payroll often feels like a high-stakes guessing game.

When payroll is handled incorrectly, the results are immediate: unhappy employees, complex government notices, and unexpected financial penalties. Many small businesses face fines annually due to payroll tax mistakes and compliance failures.

Starner Tax Group, Pea Ridge, provides proactive guidance to simplify your payroll process. We help you establish the right routines, understand payroll compliance rules, and avoid the common traps that lead to stress and legal liabilities.

The Critical Payroll Mistakes Northwest Arkansas Businesses Make

Payroll management involves more than just issuing payments. It requires strict adherence to federal and state regulations. Failure to follow IRS guidelines or rules set by the Department of Labor can lead to severe consequences, including costly audits and substantial back payments.

Understanding these risks is the first step in avoiding payroll mistakes. Here are the most common and expensive payroll errors we see local businesses encounter in NWA.

Misclassification of Workers: Employee vs. Independent Contractor

One of the largest risks facing small business payroll is incorrect worker classification. Many owners mistakenly treat long-term workers as an independent contractor to save on taxes and benefits.

The problem is that the IRS and the Department of Labor have strict rules for determining the legal status of workers. If you incorrectly classify an employee versus contractor, you may be liable for years of back FICA taxes, FUTA taxes, interest, and penalties.

You must perform an accurate worker classification analysis by evaluating behavioral control, financial control, and the relationship type. Applying the IRS’s three-category test prevents costly misclassification errors.

For every contractor you hire, ensure you collect Form W-9 (Request for Taxpayer Identification Number and Certification) before issuing payment. This helps streamline the year-end filing of Form 1099-NEC (Nonemployee Compensation).

Failing to Comply with Wage and Hour Laws

Even if you correctly identify someone as an employee, you must still follow the rules set by the Fair Labor Standards Act (FLSA). This federal law governs employee compensation and working time, especially regarding overtime.

A frequent and costly error is FLSA status misclassification, where employees are incorrectly deemed exempt from overtime pay. This can result in owed back wages and penalties because the employee’s duties and salary threshold did not meet the legal requirements.

For non-exempt employees, proper overtime calculation is mandatory. You must correctly determine the regular rate of pay used for overtime basis, which ensures compliance with federal wage and hour laws.

Setup Oversights and Recordkeeping Failures

Before you run your first payroll, several foundational steps must be completed. Failure in these areas leads to immediate payroll errors and compliance violations.

This includes obtaining your Federal EIN, registering with state agencies, and understanding state-specific requirements for SUTA taxes, especially if you operate across the Arkansas and Missouri border.

Another crucial step is proper documentation. You must collect and maintain separate, secure Form I-9 files for all employees. Failure to maintain proper recordkeeping makes it impossible to defend yourself during an audit by the IRS or the Department of Labor.

Missing Tax Deposit and Reporting Deadlines

Effective payroll management requires timely action. You must not only calculate correct tax withholdings but also deposit them with the appropriate government agencies.

This includes timely deposits to the IRS for federal taxes (like FICA taxes and FUTA taxes) and state agencies for income tax and unemployment.

Late filings of necessary forms or failure to meet strict tax deposit deadlines can incur penalties ranging from 2% to 15% of the amount due. These financial penalties often surprise busy owners.

Proactive tax compliance and payroll planning are essential to ensure timely filing and accurate reporting, protecting your small business taxes from unnecessary interest and fines.

The Most Common Payroll Mistake: Worker Classification

Running a small business in Northwest Arkansas often involves using both employees and independent contractors. One of the most serious payroll mistakes a company can make is incorrect worker classification.

The IRS (Internal Revenue Service) and the Department of Labor have strict rules that determine if a worker is truly an employee versus contractor.

If you wrongly treat an employee as an independent contractor, you avoid withholding taxes. However, you risk liability for back payroll taxes, interest, and substantial financial penalties.

This single payroll error can trigger costly audits and substantial back payments, including owed FICA taxes (Social Security and Medicare), FUTA taxes, and potentially SUTA taxes.

Accurate Analysis: Using IRS Guidelines for Worker Classification

To prevent these costly payroll errors, you must systematically evaluate the working relationship. This process is key to maintaining strong payroll compliance.

The IRS uses a three-category test for Determining Legal Status of Workers (Employee or Contractor). Getting this analysis right is the crucial first step toward avoiding major tax issues for your business.

The Three Categories of Control

The analysis focuses on control, independence, and the nature of the contract:

- Behavioral Control: This looks at whether the business has Management Oversight of Work Execution Methods. Do you control what the worker does and how they do the job?

- Financial Control: This examines who controls the economic aspects. Does the business have Management Authority Over Worker’s Business Expenses, supplies, and method of payment?

- Type of Relationship: This covers written contracts, employee benefits, and whether the relationship is expected to continue indefinitely.

Proper Documentation for Independent Contractors

If you hire an independent contractor, you must ensure you have the correct documentation for tax compliance.

Before paying a contractor, you should receive a signed Form W-9 (Request for Taxpayer Identification Number and Certification). This form provides the necessary details for year-end reporting.

At year-end, you are responsible for reporting payments to contractors using Form 1099-NEC (Nonemployee Compensation).

If you or your worker are unsure about the classification, the worker may file Form SS-8 with the IRS to get an official determination.

Properly using these IRS guidelines is essential for accurate payroll management and avoiding payroll mistakes.

The line between an employee and an independent contractor can be blurry, especially for scaling service businesses in NWA. We provide low-pressure, informed guidance to help you navigate these complex rules.

Setting Up Foundational Payroll Compliance

Before you run your very first small business payroll, you must ensure your business has completed all initial setup steps. Skipping these foundational steps is a common source of payroll tax mistakes.

Failure to register correctly leads to immediate compliance violations and potential financial penalties down the road.

Step 1: Registering with the IRS

Every business that hires employees must obtain a Federal Employer Identification Number (EIN) from the IRS (Internal Revenue Service).

Think of the EIN as the Social Security Number for your business. You cannot legally handle employee payroll or deposit federal taxes without it.

This federal setup is critical because it allows you to calculate and remit federal taxes, including income tax withholding and FICA (Federal Insurance Contributions Act) taxes, which cover Social Security and Medicare.

Step 2: State Registration for Withholding and Unemployment

Beyond federal requirements, you must register with the state agencies where your employees work. Given the cross-border reality of Northwest Arkansas, serving areas like Pea Ridge, Bella Vista, and even Southwest Missouri, this often means registering in multiple states.

State registration ensures you can pay SUTA (State Unemployment Tax Act) taxes and properly withhold state income taxes.

- Arkansas: You must register for state withholding and unemployment taxes with the Arkansas DFA (Department of Finance and Administration).

- Missouri: You must register with the Missouri DOR (Department of Revenue) for state withholding requirements and the Department of Labor for unemployment insurance.

Registering correctly is essential for ongoing payroll compliance and avoiding future audits related to state wage and hour laws.

Step 3: Mandatory New Hire Reporting

Once you have an EIN and state accounts, the final foundational step is new hire reporting. This is a mandatory part of payroll management.

You must promptly report new hires to the relevant state agency. This reporting step helps states identify individuals who may owe child support or are improperly receiving unemployment benefits.

Establishing these initial steps prevents the chaos of the “set-and-forget payroll” approach that often drifts out of compliance, leading to major payroll errors later on.

Understanding Payroll Taxes: Withholding, Matching, and Deposits

Once your business is registered, the next step is mastering small business payroll calculations.

Payroll taxes are complex because they involve two parts: money taken from the employee’s pay (withholding) and money paid directly by the employer (matching taxes).

Accurate calculation and timely payment are essential for tax compliance and avoiding costly payroll mistakes.

Mandatory Federal Withholding: FICA and Income Tax

Employers must withhold specific federal taxes from every employee paycheck. These withheld amounts are held in trust until you deposit them with the government.

These taxes include federal income tax withholding and FICA taxes, which fund Social Security and Medicare.

FICA (Federal Insurance Contributions Act) Taxes

FICA (Federal Insurance Contributions Act) taxes are split between the worker and the business. The employee pays half, and the employer must pay the matching half.

Monitoring the annual Social Security wage caps is vital for precise calculation. Failure to monitor these caps risks over- or under-withholding, which can lead to significant financial penalties from the IRS (Internal Revenue Service).

Federal Income Tax Withholding

Federal Income Tax withholding is based on the information the employee provides to you on their Form W-4.

If an employee fails to provide a W-4 form, IRS guidelines require you to withhold tax at the highest single rate. This is known officially as the Mandatory Tax Deduction Due to Missing Identification Information.

Unemployment Taxes: FUTA and SUTA

As an employer, you are solely responsible for paying federal and state unemployment taxes.

- FUTA (Federal Unemployment Tax Act): This is a federal tax paid only by the employer. These funds support state workforce agencies.

- SUTA (State Unemployment Tax Act): This is the state-level unemployment tax. The rate varies based on your state and your company’s history of unemployment claims.

For businesses in Northwest Arkansas and Southwest Missouri, managing multi-state operations is common.

You must adhere to specific Arkansas and Missouri SUTA taxes requirements based on where the employee works, adding another layer of complexity to payroll compliance.

Adherence to Fiscal Regulations: Tax Deposit Deadlines

One of the most common payroll tax mistakes small businesses make is missing the deadlines set by the IRS for depositing these withheld taxes.

The IRS guidelines set strict Tax Deposit Deadlines based on the total tax liability your business accumulates, often requiring monthly or semi-weekly schedules.

Late deposits trigger immediate interest and financial penalties, which can range from 2 percent to 15 percent depending on how late the deposit is.

Staying on top of these deadlines is critical for strong Payroll management and prevents the kind of payroll errors that result in unexpected liabilities.

This is why many busy Bentonville and NWA owners rely on proactive service providers to handle these critical deadlines, ensuring timely payments and accurate reporting.

Avoiding Costly Wage and Hour Law Violations

Payroll compliance goes beyond just filing taxes. Growing small businesses in Northwest Arkansas must also adhere to strict federal and state Wage and hour laws.

These laws are primarily governed by the Department of Labor (DOL) through the Fair Labor Standards Act (FLSA). Failing to follow these rules is a major source of payroll errors and can lead to significant financial penalties and legal liabilities.

Critical Step: Employee vs. Independent Contractor Classification

One of the most expensive payroll mistakes a business can make is misclassifying workers. Many owners assume they can pay someone using Form 1099-NEC and treat them as an independent contractor.

However, the IRS and the Department of Labor use specific guidelines to determine the worker’s true status. Incorrect worker classification can lead to liability for back payroll taxes, penalties, and interest.

To analyze the worker’s legal status, the IRS looks at factors like behavioral control, financial control, and the relationship between the parties. We stress a systematic evaluation based on these factors to prevent costly misclassification errors and ensure proper tax compliance.

If you utilize an independent contractor, you must collect a completed Form W-9 before issuing payments. Getting this right is crucial for overall payroll compliance.

Accurate Overtime Calculation and the Regular Rate of Pay

The FLSA mandates that most employees who work over 40 hours in a single workweek receive overtime pay. This must be paid at one-and-a-half times their regular rate of pay.

Calculating the regular rate of pay is often where payroll errors occur. It is not just the employee’s standard hourly wage.

The regular rate must include almost all types of compensation, such as non-discretionary bonuses and certain commissions. Incorrect computation of wages for excess working hours is a common trigger for Department of Labor audits.

These audits often result in the business owing significant back wages and penalties because the overtime calculation was incorrect.

Understanding Exempt vs. Non-Exempt Status

Another major source of payroll errors involves misclassification under the FLSA: determining eligibility for overtime protection. This is known as FLSA Status Misclassification.

Many small business owners mistakenly believe that paying an employee a fixed salary automatically makes them exempt from overtime rules. This is often untrue.

To qualify as exempt, an employee must meet two strict criteria: they must meet a specific salary threshold, and they must pass complex job duties tests.

These duties tests evaluate the actual work performed, such as executive, administrative, or professional duties. This precise analysis is known as the determination of eligibility for overtime protection.

Incorrect exemption status can result in massive owed back wages and financial penalties. This is why proper duty analysis is mandatory for effective payroll management.

Critical Documentation and Recordkeeping

Accurate payroll compliance depends entirely on clear, organized documentation. For small businesses in Bentonville and across Northwest Arkansas, recordkeeping failures are a major vulnerability.

If the IRS (Internal Revenue Service) or the Department of Labor contacts you, your records are your only defense. Proper documentation is crucial to defend against audits and avoid severe financial penalties.

Defending Against Audits: What Records You Must Keep

The rules for recordkeeping are set by both federal and state IRS guidelines and the Department of Labor. You must maintain time records, pay rates, and complete documentation for all deductions and additions to wages.

This organized system is essential for accurate payroll management and adherence to Fiscal Regulations.

Documentation Required for Employees

For every person on your payroll, you must collect and maintain specific forms and records. These documents prove you are meeting your payroll compliance obligations.

- Form I-9 (Employment Eligibility Verification): This proves the employee is authorized to work in the United States. These files must be kept separate and secure.

- Form W-4 (Employee’s Withholding Certificate): This form tells you how much federal income tax withholding to take out of each paycheck.

- Time Records: Detailed records of hours worked, especially for workers who receive overtime (non-exempt employees), are mandatory under federal wage and hour laws.

The Risk of Worker Classification Errors

One of the costliest payroll mistakes small businesses make involves worker classification. This means incorrectly treating an employee as an independent contractor.

Misclassifying workers can lead to substantial legal liabilities for back payroll taxes, penalties, and interest.

If you cannot prove a worker is truly an independent contractor, the IRS will hold you responsible for unpaid FICA taxes (Federal Insurance Contributions Act) and FUTA taxes (Federal Unemployment Tax Act).

Documentation Required for Independent Contractors

If your growing business uses independent contractors, you must follow specific IRS guidelines to maintain payroll compliance.

Before you pay them, you must collect Form W-9 (Request for Taxpayer Identification Number and Certification). This form provides the contractor’s taxpayer identification number necessary for year-end reporting.

When you pay an independent contractor $600 or more during the year, you must issue them Form 1099-NEC (Nonemployee Compensation).

Timely filing of these forms with the IRS is critical. Late filings or errors on Form 1099-NEC carry their own set of financial penalties, which can range from 2% to 15% of the amount that should have been reported.

How to Avoid Worker Misclassification

Avoiding payroll errors starts with a systematic analysis based on IRS guidelines for Determining Legal Status of Workers (Employee or Contractor).

The IRS uses a three-category test (Behavioral Control, Financial Control, and Relationship Type) to determine the correct status. For instance, if you dictate the Management Oversight of Work Execution Methods, the worker is likely an employee.

Getting the worker classification right is essential for minimizing future payroll tax mistakes and audits.

If you are unsure about a worker’s status, you can file Form SS-8 with the IRS to request a determination, ensuring you meet the mandatory tax deduction requirements.

Worker Classification: The Difference Between Employee and Independent Contractor

Running a growing business in Northwest Arkansas means you must know exactly who is an employee and who is an independent contractor. Getting this worker classification wrong is one of the most common and costly payroll mistakes.

The difference affects everything from filing deadlines to your overall tax compliance. Misclassification can lead to serious financial penalties from both the IRS (Internal Revenue Service) and the Department of Labor.

The High Cost of Worker Classification Errors

If you treat a worker as an independent contractor but the IRS determines they are legally an employee, your small business payroll instantly faces massive problems.

You become liable for back payroll taxes, including the employer portion of FICA taxes (Social Security and Medicare), and required unemployment contributions (FUTA taxes and SUTA taxes).

These errors often trigger costly audits and can result in substantial back payments, penalties, and interest. This is a significant source of legal liabilities for busy NWA owners.

Accurate Classification Analysis: Following IRS Guidelines

The worker’s job title or the existence of a signed contract does not determine their status. To prevent payroll errors, you must follow IRS guidelines and conduct a systematic evaluation based on three main categories. This analysis is key to Determining Legal Status of Workers (Employee or Contractor).

- Behavioral Control: Does your business control or have the right to control how, when, and where the worker performs the job? This includes providing specific instructions or training.

- Financial Control: Does the business control the financial aspects of the job? Factors include how the worker is paid, whether expenses are reimbursed, and who provides the tools and supplies.

- Type of Relationship: Are there written contracts describing the relationship? Does the worker receive benefits like insurance or a pension? How permanent is the relationship expected to be?

If you need an official determination, either the business or the worker can file Form SS-8 with the IRS. This requests the agency to review the facts and formally decide the worker’s status for federal employment tax purposes.

Proper Documentation: W-9, I-9, and Payroll Records

Payroll compliance depends entirely on having the correct paperwork from day one. Recordkeeping failures often start with missing or incorrect initial forms.

For every employee, you must maintain a separate file containing Form W-4 for accurate tax withholding and Form I-9 for employment eligibility verification.

For every independent contractor, you must collect Form W-9 (Request for Taxpayer Identification Number and Certification) before you issue any payments. This ensures you have the necessary information to file the year-end Form 1099-NEC (Nonemployee Compensation).

Comparing Requirements at a Glance

Understanding these fundamental differences is crucial for effective payroll management and Avoiding payroll mistakes. This table summarizes the basic documentation and tax responsibilities for each type of worker.

| Requirement | Employee (W-2) | Independent Contractor (1099-NEC) |

|---|---|---|

| Required Forms from Worker | W-4, I-9 | W-9 |

| Employer Withholds Taxes (FICA, Income) | Yes | No |

| Employer Pays Unemployment Taxes (FUTA, SUTA) | Yes | No |

| Year-End Reporting Form Issued | W-2 | 1099-NEC |

| Overtime Protection (FLSA) | Yes (Unless Exempt) | No |

Wage and Hour Law Compliance

Beyond classification, you must also adhere to federal and state Wage and hour laws. The Fair Labor Standards Act (FLSA) dictates rules for minimum wage, recordkeeping, and overtime calculation.

This is a major source of payroll tax mistakes.

You must correctly determine if an employee is exempt or non-exempt from overtime rules. Incorrectly classifying a worker as exempt from the FLSA when they should receive overtime can result in significant penalties and owed back wages, enforced by the Department of Labor.

A simple salary does not automatically make an employee exempt. Proper duty analysis is mandatory to avoid penalties related to Computation of Wages for Excess Working Hours.

Protecting Your Small Business from Payroll Errors

Running a growing business in Northwest Arkansas means juggling many responsibilities. For busy owners in Bentonville, Rogers, and Centerton, managing payroll often feels like a high-stakes guessing game.

When payroll management is handled incorrectly, the results are immediate: unhappy employees, complex government notices, and unexpected financial penalties. These payroll errors can lead to serious legal liabilities if left unaddressed.

The “villain” in this story is the last-minute scramble and the DIY filing traps that lead to costly mistakes. Relying on “set-and-forget” payroll processes puts your business at risk of drifting out of compliance.

Avoiding Costly Worker Classification Mistakes

One of the most common and costly payroll mistakes is incorrect worker classification. You must correctly determine if a worker is a W-2 employee or an independent contractor.

Misclassifying employees as independent contractors can lead to substantial liability for back payroll taxes, including FICA taxes, along with significant penalties and interest. Both the IRS (Internal Revenue Service) and the Department of Labor provide strict guidelines for this determination.

We stress the importance of a systematic evaluation based on behavioral control, financial control, and the relationship between the parties. Failure to apply the IRS’s three-category test prevents small business owners from avoiding payroll mistakes that trigger costly audits.

Compliance with Wage and Hour Laws (FLSA)

Beyond classification, you must adhere to federal wage and hour laws, primarily governed by the Fair Labor Standards Act (FLSA). This act dictates minimum wage, recordkeeping, and overtime rules.

A critical payroll error involves FLSA status misclassification, where employees are incorrectly labeled as exempt from overtime pay. This mistake can result in owed back wages and penalties from the Department of Labor.

It is crucial to correctly apply the FLSA’s duties tests and salary thresholds. Simply paying someone a salary does not automatically make them exempt from receiving overtime calculation based on their regular rate of pay.

Handling Payroll Taxes: Withholding and Deposits

Once workers are correctly classified, the next challenge is accurate tax compliance. This involves precise calculation and timely deposit of payroll taxes, such as FICA, FUTA, and state SUTA taxes.

Timely filing and meeting tax deposit deadlines are vital. Late filings or late deposits can incur financial penalties ranging from 2% to 15% of the amount owed. We ensure Social Security caps are monitored to prevent over- or under-withholding.

For Northwest Arkansas businesses that operate across state lines, managing Arkansas and Missouri state withholding rules adds complexity. This is where compliance-minded processes are essential.

The Importance of Proper Documentation and Recordkeeping

Failure to maintain solid recordkeeping invites IRS scrutiny. Proper documentation is crucial to defend your business against audits.

Before working with an independent contractor, you must collect a completed Form W-9 (Request for Taxpayer Identification Number and Certification). For employees, strict adherence to collecting Form I-9 and maintaining separate, secure payroll records is mandatory.

Furthermore, timely filing of Form 1099-NEC (Nonemployee Compensation) for contractors and Form W-2s for employees at year-end is a non-negotiable part of payroll compliance.

Starner Tax Group, Pea Ridge: Your Payroll Compliance Guide

Juggling state-specific rules, monitoring tax deposit deadlines, and ensuring accurate worker classification takes time that busy, scaling owners often do not have. Starner Tax Group, Pea Ridge, offers proactive, full-service tax prep and planning to eliminate this stress.

We focus on eliminating the chaos and bad practices people want to avoid. We provide payroll services with compliance-minded processes, ensuring you avoid unexpected financial penalties and legal liabilities.

Our approach is low-pressure and personalized. We tailor the process to your business model, whether you experience seasonal spikes or steady growth, ensuring full adherence to federal and state regulations.

How We Handle Payroll for Northwest Arkansas Businesses

We take care of everything, from planning to accurate filing, so you can stress less and focus on running your growing business in Bentonville, Rogers, or Centerton.

We build a personalized plan around your income pattern, entity type, and growth goals. Here is how we ensure your payroll management is stable and compliant:

- Proactive Setup: We ensure you have your Federal EIN, state registrations (AR and MO), and all necessary forms (W-9, W-4, I-9) collected before the first payday, preventing initial business and employee setup oversights.

- Accurate Calculations: We manage state withholding, FICA, FUTA, and SUTA calculations precisely, monitoring Social Security caps and complex overtime calculation rules defined by the Department of Labor.

- Timely Reporting: We handle the reporting cadence, including quarterly reviews, tax deposits, and year-end form issuance (W-2s and Form 1099-NEC).

- Payroll Health Checks: We offer ongoing monitoring to ensure employee versus contractor classification and exemption statuses remain correct as your team grows, reducing the risk of costly payroll errors.

By relying on a local team, you can transition payroll management from a source of stress into a stable, compliant operation. Let us help you save time, money, and stress by handling your complex payroll needs.

Frequently Asked Questions About Payroll Compliance

What is the most serious payroll mistake small businesses in NWA encounter?

One of the most common and costly payroll mistakes is Worker classification error. This happens when a business treats a true employee as an independent contractor.

The IRS (Internal Revenue Service) and the Department of Labor strictly enforce rules regarding the Determining Legal Status of Workers (Employee or Contractor). Misclassifying employees can lead to substantial legal liabilities, including owing back payroll taxes, penalties, and interest.

In fact, incorrect classification can trigger costly audits and result in substantial back payments. Penalties for these payroll errors can range from 2% to 15% of the unpaid taxes.

How do the IRS and Department of Labor determine worker status?

The determination hinges on the degree of control the business has over the worker. The IRS uses a three-category test focusing on Behavioral Control, Financial Control, and the Relationship of the Parties.

For example, if your business dictates the hours, provides the tools, and exercises Management Oversight of Work Execution Methods, the worker is likely an employee.

If the worker has independence, manages their own business expenses, and provides their own equipment, they are likely an independent contractor.

If you are unsure of a worker’s status, you can file Form SS-8 with the IRS to seek an official determination. Accurate Worker Classification Analysis is crucial for avoiding future problems.

How do I avoid FLSA Status Misclassification?

The Fair Labor Standards Act (FLSA) governs minimum wage and overtime requirements. A major payroll compliance failure is incorrectly labeling an employee as “exempt” from overtime pay.

You must correctly apply the FLSA’s duties tests and salary thresholds for the Determination of Eligibility for Overtime Protection. Simply paying an employee a salary does not automatically make them exempt from overtime.

If an employee is non-exempt, you must pay them 1.5 times their regular rate of pay for all hours worked over 40 in a workweek. Incorrect overtime calculation is a serious wage and hour law violation that results in owed back wages and penalties.

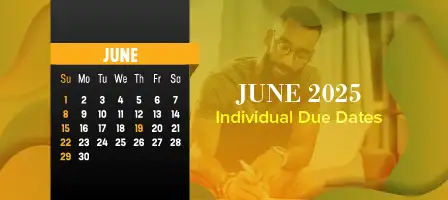

What are the critical tax reporting deadlines I must meet?

Small business payroll requires strict adherence to fiscal regulations regarding timely filing and deposits. You must meet specific Tax deposit deadlines for federal payroll taxes (FICA taxes, FUTA taxes, and income tax withholding).

Additionally, if you paid an independent contractor $600 or more, you must issue and file Form 1099-NEC (Nonemployee Compensation) with the IRS. This deadline is typically January 31st.

Late filings of 1099-NEC forms, tax deposits, or quarterly reports can incur significant financial penalties and interest from the IRS.

What are FICA, FUTA, and SUTA taxes?

These are the primary employer taxes required for Tax compliance:

- FICA (Federal Insurance Contributions Act) taxes: These fund Social Security and Medicare. Both the employer and the employee contribute to FICA.

- FUTA (Federal Unemployment Tax Act) taxes: This is a federal tax paid solely by the employer to fund unemployment benefits.

- SUTA (State Unemployment Tax Act) taxes: This state-level tax varies between Arkansas and Missouri. As a business owner in Northwest Arkansas, you must ensure you comply with the specific requirements for each state where you have employees.

Precise calculation and timely deposit of these taxes are essential Payroll management duties. Failure to monitor annual Social Security wage caps or making late deposits leads directly to Payroll tax mistakes.

What foundational steps must I take before running my first payroll?

Initial Business and Employee Setup Oversights are common sources of early compliance violations. You must first obtain a Federal Employer Identification Number (EIN) from the IRS.

Next, you must register your business with the state agencies in Arkansas and/or Missouri for state income tax withholding and SUTA. You must also report new hires promptly to the state.

These steps are necessary to ensure your business has the legal authority to withhold and remit taxes, helping you avoid immediate compliance violations.

What documentation must I keep for employees and contractors?

Proper Documentation and Recordkeeping failures are major red flags during an audit. For every employee, you must keep accurate payroll records showing hours worked, wages paid, and deductions taken.

For independent contractors, you must collect Form W-9 (Request for Taxpayer Identification Number and Certification) before issuing payment. This form confirms the contractor’s taxpayer identification number.

If you fail to obtain a valid W-9, the IRS guidelines may require you to perform backup withholding, resulting in a Mandatory Tax Deduction Due to Missing Identification Information.

What is the importance of accurate overtime calculation?

Accurate overtime calculation is required by Statutes Governing Employee Compensation and Working Time. For non-exempt employees, the overtime rate is based on the Standard Hourly Wage Used for Overtime Basis, which may include non-discretionary bonuses or commissions.

The Department of Labor frequently audits businesses for errors in the Computation of Wages for Excess Working Hours. If your business has employees commuting between Arkansas and Missouri, understanding multi-state wage laws is especially important for avoiding payroll mistakes.

Can Automated payroll software prevent all Payroll errors?

Automated payroll software is a powerful tool for reducing the risk of common Payroll errors, especially related to complex calculations and Tax deposit deadlines.

However, automation cannot fix underlying problems like incorrect Worker classification or inaccurate FLSA status settings. The system is only as good as the information you input.

You still need strong internal processes and professional guidance to ensure the initial setup and ongoing monitoring remain compliant with all IRS guidelines and Department of Labor rules.

Frequently Asked Questions About Payroll Compliance

What are the biggest financial penalties related to payroll?

The most severe financial penalties stem from two main areas: late payments and Worker classification errors.

If you submit tax payments late to the IRS (Internal Revenue Service), penalties can quickly escalate. Late tax deposits can result in Financial penalties up to 15 percent of the unpaid amount, plus interest. These Tax deposit deadlines are critical for Small business payroll health.

The second major risk is misclassifying an employee as an Independent contractor. This triggers liability for years of back payroll taxes, including the employer and employee share of FICA (Federal Insurance Contributions Act) taxes, FUTA (Federal Unemployment Tax Act), and SUTA (State Unemployment Tax Act).

Incorrect classification can trigger costly audits and substantial back payments, leading to major Legal liabilities for the business.

How often should small businesses run payroll?

While federal law does not dictate a single frequency, maintaining a Consistent Payroll Schedule is essential. Most states, including Arkansas and Missouri, require consistency.

Common schedules are weekly, biweekly (every two weeks), or semimonthly (twice a month).

Choosing a consistent schedule helps ensure timely tax deposits are met, which is a core part of Payroll compliance and good employee relations.

What is the Department of Labor’s role in my payroll?

The Department of Labor enforces the Fair Labor Standards Act (FLSA). This federal law governs Wage and hour laws, including minimum wage and overtime requirements.

A common Payroll mistake is FLSA Status Misclassification. This happens when a business incorrectly labels an employee as exempt from overtime pay.

The determination of Eligibility for Overtime Protection is complex. It requires applying specific duties tests and salary thresholds, not just paying a salary.

The DOL also ensures the correct Computation of Wages for Excess Working Hours by enforcing the accurate determination of the Standard Hourly Wage Used for Overtime Basis (known as the regular rate of pay). Violations often result in costly back-wage requirements and penalties.

How do I accurately determine if someone is an employee or an independent contractor?

The IRS and the Department of Labor strictly enforce rules regarding the Determining Legal Status of Workers (Employee or Contractor). They focus on the degree of control you have over the worker.

The Accurate Worker Classification Analysis uses three main categories based on IRS guidelines:

- Behavioral Control (Management Oversight of Work Execution Methods): Does the business control when, where, and how the work is done?

- Financial Control (Management Authority Over Worker’s Business Expenses): Does the business control the business aspects of the job, such as who provides the tools or how expenses are reimbursed?

- Relationship: Are there written contracts, benefits, or a stated expectation of a long-term relationship?

Misclassification is a serious Payroll tax mistake. If you are unsure, you can seek professional advice or file Form SS-8 with the IRS to request a formal determination.

What foundational setup steps prevent Initial Business and Employee Setup Oversights?

Before running your first Small business payroll, several foundational steps must be completed to ensure Tax compliance and avoid early penalties.

First, you need a Federal Employer Identification Number (EIN) from the IRS.

Second, you must register your business promptly with the appropriate state agencies for income tax withholding and unemployment insurance (SUTA).

Third, you must complete new hire reporting promptly with the state where the employee works. Recordkeeping failures at this stage can lead to compliance violations.

What documentation is critical for Avoiding Payroll Mistakes?

Proper documentation is essential for defending against audits and minimizing Payroll errors related to tax withholding and classification.

For all employees, you must obtain and securely maintain Form I-9 (Employment Eligibility Verification) and Form W-4 (Employee’s Withholding Certificate).

If you pay an Independent contractor, you must receive a completed Form W-9 (Request for Taxpayer Identification Number and Certification) before issuing payment.

At year-end, contractors who received over $600 must receive Form 1099-NEC (Nonemployee Compensation). Failure to file this form by the deadline is a major Payroll tax mistake that incurs penalties.

Maintaining accurate and complete records regarding hours worked and compensation is mandatory under the FLSA and prevents Recordkeeping failures.

If I use automated payroll software, am I protected from mistakes?

Automated payroll software is a powerful tool for Payroll management, handling calculations and meeting Tax deposit deadlines.

However, software is only as accurate as the data you put in. It cannot perform the initial legal analysis, such as determining the Legal Status of Workers (Employee or Contractor).

Owners must still perform accurate Worker classification and provide correct input regarding hours, compensation, and exemption status. Relying solely on software without proper oversight is a major source of Payroll errors.

Do I need to worry about payroll taxes if my business is in Pea Ridge but my employees commute from Missouri?

Yes, absolutely. This cross-border reality is crucial for businesses across Northwest Arkansas, including Bentonville, Rogers, Centerton, and Pea Ridge, especially with workers commuting from Southwest Missouri.

You must comply with the withholding rules of the state where the employee works, and potentially the state where they live.

Starner Tax Group, Pea Ridge, understands this common challenge and handles state-specific steps for both Arkansas and Missouri, ensuring compliance with SUTA and income tax rules in both states.

*

Avoiding Costly Payroll Tax Mistakes

Running payroll involves more than just writing a check. The government requires strict adherence to specific rules concerning how you classify workers and calculate what they are owed. Ignoring these rules is one of the most common ways busy small business owners face unexpected legal liabilities and financial penalties.

The Critical Mistake: Worker Classification Errors

One of the largest payroll mistakes a small business can make is misclassifying a worker. The IRS (Internal Revenue Service) and the Department of Labor both have strict guidelines defining whether someone is an employee or an independent contractor.

If you treat an employee as an independent contractor, you might avoid withholding taxes initially. However, if the IRS later determines the worker was an employee, your business is liable for all back payroll taxes, including both the employer’s and employee’s share of FICA taxes (Social Security and Medicare), FUTA taxes (Federal Unemployment Tax Act), and SUTA taxes (State Unemployment Tax Act).

The penalties and interest on these back payments can quickly escalate, causing severe financial strain.

How to Determine Legal Status of Workers

The IRS uses three main categories to analyze accurate worker classification:

- Behavioral Control: Does your business control or have the right to control what the worker does and how the worker does their job? Management Oversight of Work Execution Methods is a key factor here.

- Financial Control: Does your business control the business aspects of the worker’s job? This includes how the worker is paid, whether expenses are reimbursed (Management Authority Over Worker’s Business Expenses), and who provides tools and supplies.

- Type of Relationship: Are there written contracts describing the relationship? Does the worker receive benefits like insurance or a pension?

If you are unsure about a worker’s status, you can file Form SS-8 with the IRS to get a determination. For every independent contractor you hire, you should collect Form W-9 (Request for Taxpayer Identification Number and Certification) before issuing Form 1099-NEC (Nonemployee Compensation) at year-end.

Compliance with Wage and Hour Laws (FLSA)

Beyond classification as an employee or independent contractor, you must also correctly classify employees under the Fair Labor Standards Act (FLSA). This law governs minimum wage, overtime pay, and recordkeeping.

A common payroll error is incorrect FLSA Status Misclassification, treating a salaried employee as “exempt” from overtime when they should be “non-exempt.” Incorrect exemption status can result in owed back wages and penalties.

To determine Eligibility for Overtime Protection, you must apply the FLSA’s duties tests and salary thresholds, salary alone does not make an employee exempt.

For non-exempt employees, Computation of Wages for Excess Working Hours requires careful attention to the Regular Rate of Pay. This is often complex and requires more than just the hourly wage to calculate the correct overtime rate.

Avoiding Initial Setup and Tax Deposit Deadlines Oversights

Before you run your first small business payroll, you must perform initial setup oversights. This includes obtaining a Federal EIN and registering with state agencies in Arkansas and/or Missouri.

Another area of high risk is Tax Deposit Deadlines. These deadlines vary based on the size of your payroll, and missing them results in immediate financial penalties. Late deposits can accrue interest and penalties ranging from 2% to 15% of the unpaid amount.

Furthermore, new hire reporting is mandatory and requires prompt attention. Failure to report new employees to state agencies on time can also result in compliance violations.

The Importance of Recordkeeping and Documentation

Failure to maintain excellent recordkeeping is often the reason businesses lose audits. Adherence to Fiscal Regulations means keeping meticulous records for all employees, including hours worked and compensation paid, for several years.

In addition to payroll records, you must maintain separate, secure Form I-9 files for every employee to verify their identity and employment authorization. Proper documentation is crucial to defend against audits and avoid penalties from both the IRS and the Department of Labor.

Stop Worrying About Payroll Compliance

Don’t let the stress of managing payroll compliance impact your focus or lead to unwelcome surprises from the IRS. For busy owners in Bentonville, Rogers, and Centerton, juggling payroll compliance alongside daily operations is a major burden.

Starner Tax Group, Pea Ridge, offers full-service tax prep and planning, alongside reliable payroll management. We provide personalized attention and expert guidance to help you navigate complex payroll tax mistakes and worker classification rules.

We understand the cross-border reality of Northwest Arkansas and Southwest Missouri (up to Cassville, MO), ensuring your multi-state filing considerations are handled correctly.

We help you save time, money, and stress by focusing on Tax Compliance and accurate Payroll Management.

Ready to Simplify Your Small Business Payroll?

If you have received an IRS letter, or if you are simply tired of the last-minute scramble to meet tax deposit deadlines, our local team is here to help.

We take a low-pressure approach to assess your current situation and build a plan tailored to your business model.

Take the Next Step:

- Call: 479-451-1040

- Address: Pea Ridge, AR

- Client Portal / Upload Files option available for convenience