1099 vs W-2: Classification Basics for NWA Businesses

TL;DR (Too Long; Didn’t Read)

- Classification Core: The IRS determines if a worker is a W-2 employee or a 1099 contractor based on the level of control the business exerts (Behavioral, Financial, and Relationship). High control indicates W-2 status.

- Tax Burden: For W-2 employees, the employer handles withholding and pays half of FICA taxes. 1099 contractors are responsible for the full 15.3% self-employment tax and must make quarterly estimated tax payments.

- Risk and Cost: Misclassification (treating an employee as a contractor) risks severe misclassification penalties from the IRS and DOL, including back taxes, interest, and fines. W-2 employees also require the business to pay payroll taxes, unemployment insurance, and employee benefits.

- Strategic Choice: Growing NWA businesses often transition key workers to W-2 status to achieve greater quality control, secure better talent (via employer provided benefits), and significantly reduce long-term legal compliance risks.

Why Worker Classification Matters to Your Bottom Line

For growing businesses across Northwest Arkansas, from Bentonville to Rogers, managing your workforce correctly is essential. One of the biggest challenges business owners face is deciding if a worker is a W-2 employee or a 1099 independent contractor.

Getting this wrong, known as misclassification, can lead to serious consequences, including significant misclassification penalties from the Internal Revenue Service (IRS) and the Department of Labor.

At Starner Tax Group (Pea Ridge), we help busy owners understand these distinctions. It is the chaos of “set-and-forget payroll” that often leads to compliance issues.

The IRS Test: Determining Level of Control

The IRS uses three main factors to determine proper worker classification. These factors all center on the level of control the business has over the worker.

Misclassification is a major pain point because the rules are not always obvious. You must look at the entire relationship, not just what you call the worker.

1. Behavioral Control

This factor looks at whether the business controls what the worker does and how they do their job. If you provide detailed instructions, training, or dictate the tools and location, this points toward a W-2 employee.

For example, if a worker must follow set work hours and specific procedures defined by the company, the IRS sees high control.

2. Financial Control

This looks at how the worker is paid and who provides the equipment. Do they incur unreimbursed expenses? Can they seek out other business opportunities?

A 1099 independent contractor typically invests in their own equipment, pays their own operating costs, and can realize a profit or loss from their services.

3. Type of Relationship

This covers written contracts, the availability of employee benefits, and how long the relationship is expected to last. Providing employer provided benefits like a 401(k) plan, health insurance, or paid time off is a strong indicator of an employer-employee relationship.

A contractor relationship is usually temporary or project-based, while an employee relationship is intended to continue indefinitely.

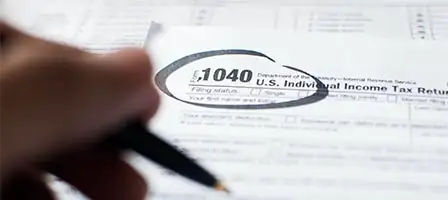

Tax Implications: W-2 Employees vs. 1099 Contractors

The financial and tax differences between the two worker types are substantial for both the worker and the business.

W-2 Employees and Withholding

For W-2 employees, the business handles the heavy lifting of payroll taxes. You, the employer, are responsible for withholding federal income tax, state income tax (crucial in both Arkansas and Missouri), and half of the FICA taxes (Social Security and Medicare).

This automatic withholding simplifies tax obligations for the employee, as they receive their pay after these mandatory taxes are taken out.

1099 Contractors and Self-Employment Tax

When you pay a 1099 independent contractor, you typically pay them the gross amount without withholding any taxes. This means the contractor is entirely responsible for their own tax burden.

Contractors must pay the full 15.3% self-employment tax, which covers both the employee and employer portions of Social Security and Medicare.

To avoid a surprise bill, contractors must make quarterly estimated tax payments to the IRS and state agencies throughout the year. This difference in responsibility is a key distinction for cash flow planning.

Understanding Business Costs and Legal Compliance

While paying a 1099 contractor might seem simpler on the surface, the overall costs to business and compliance risks must be carefully weighed.

Employer Responsibilities for W-2 Workers

Hiring a W-2 employee brings specific financial and legal employer responsibilities. The business must pay its share of FICA taxes, as well as federal and state unemployment insurance premiums.

You must also carry workers’ compensation insurance, and W-2 workers are protected by federal and state labor laws, including minimum wage and overtime regulations.

Offering competitive employee benefits, such as retirement plans or health insurance, is often necessary to attract and retain workers in the competitive NWA market, adding to the overall cost.

Legal Compliance and Misclassification Risk

The biggest risk associated with 1099 contractors is legal compliance. W-2 employees are covered by strict labor protections, but 1099 contractors are governed primarily by contract terms.

If the Department of Labor determines that your 1099 contractor should have been classified as a W-2 employee based on the level of control you exerted, the business faces severe penalties.

These penalties include having to pay back taxes, interest, fines, and potentially covering the cost of missed benefits or overtime. Even though the AB5 Law (California) does not directly apply here, similar classification scrutiny exists across all states, including Arkansas and Missouri.

Why Businesses Transition to a W-2 Workforce

Many busy, scaling businesses realize that relying heavily on 1099 contractors introduces unnecessary risk and limits growth potential. Transitioning workers to W-2 status often reduces legal compliance risks significantly.

A dedicated W-2 workforce allows owners to maintain greater supervision, ensuring service quality and consistent brand representation, a necessity for growth-minded teams in Centerton and Bella Vista.

Furthermore, some large commercial clients or government contracts may require that your staff be W-2 employees for their own liability reasons.

While contractors might charge higher hourly rates to compensate for their lack of employer provided benefits and full self-employment tax burden, the stability and control provided by W-2 status often outweigh the short-term cost savings.

Proactive Payroll Strategy and Risk Assessment

If you are unsure about your current worker classifications, especially if you operate across state lines in Northwest AR and Southwest Missouri, it is critical to perform an assessment and risk analysis.

Handling payroll processing correctly is key to avoiding the stress of tax surprises. Starner Tax Group (Pea Ridge) specializes in developing proactive payroll strategy and ensuring compliance-minded processes.

We work with you to clean up your documentation, update worker agreements, and establish clear policies to protect your business from costly IRS notices and penalties.

Understanding Worker Classification in Northwest Arkansas

If you are running a business in Pea Ridge, Bentonville, or anywhere across Northwest Arkansas, growth means adding workers. Deciding how to correctly classify those workers is one of the most critical decisions you will make.

Worker classification determines your legal obligations, payroll taxes, and what kind of control you have over the job. Getting this process wrong is known as misclassification.

Misclassification can lead to serious consequences, including large penalties from the Internal Revenue Service (IRS) and the Department of Labor (DOL). This is a risk no busy, scaling business should take.

We help Northwest Arkansas businesses understand the core differences between a W-2 employee and a 1099 independent contractor.

The Key Difference: Level of Control

The most important factor determining if a worker is a W-2 employee or a 1099 independent contractor is the level of control you, the business owner, have over that worker.

This key factor impacts everything from your employer responsibilities to the worker’s tax situation.

For W-2 employees, you control not only the result of the work, but also how, when, and where the work is done. You set the hours and provide the tools necessary for the job.

For 1099 contractors, the worker maintains independence. They set their own schedules, use their own methods, and often supply their own equipment. You control the final result, but not the day-to-day process.

This difference in the level of control is what triggers specific tax implications for both you and the worker.

The Core Difference: Level of Control

The Internal Revenue Service (IRS) uses specific criteria to determine proper worker classification. For business owners in Bentonville and Northwest Arkansas, understanding this is vital.

The biggest factor the IRS and the Department of Labor (DOL) look at is the level of control you exert over the worker. Getting this analysis wrong can lead to costly misclassification penalties.

W-2 Employees: High Control

For W-2 employees, the business has significant authority over how the work is performed. You control the process, the tools, and the schedule.

- You set the work hours and often dictate the location where the work must happen.

- You provide the necessary tools, equipment, and training required for the job.

- The work performed is typically a core, integral part of your business operations.

- You supervise tasks closely and manage the worker’s performance and output.

This relationship means the W-2 employee is dependent on your business for direction and resources. Your business carries significant employer responsibilities for these workers.

1099 Contractors: High Independence

In contrast, a 1099 independent contractor operates with a high degree of independence. You hire them for a specific result or project, not for their time or method.

- They set their own hours and decide where and how they complete the project.

- They typically use their own tools and methods, managing their own business expenses.

- They are generally free to work for multiple clients or businesses at the same time.

When you hire an independent contractor, you are hiring their expertise. You are focused on the final product, not the daily supervision. This high independence is the defining trait of the 1099 relationship.

The distinction between the level of control matters greatly, especially when looking ahead at tax implications and costs to business.

Understanding the Tax Implications: 1099 vs W-2

Once you determine the correct worker classification, the tax implications become the most important factor to manage.

This difference in how taxes are handled is often the most visible and potentially the most costly compliance issue for growing businesses in Northwest Arkansas.

W-2 Employee Tax Withholding and FICA Taxes

For W-2 employees, the tax process is greatly simplified for the worker because the employer handles the heavy lifting through payroll taxes.

Your business is responsible for withholding federal, state, and local income taxes from every single paycheck.

The employer must also pay half of the required FICA taxes, which fund Social Security and Medicare. The employee’s half is automatically withheld from their wages.

These employer responsibilities ensure taxes are paid throughout the year, simplifying the employee’s tax obligations when they file their annual return.

1099 Contractor Responsibility: Self-Employment Tax

For 1099 independent contractors, the entire tax burden shifts directly to the worker. They are considered self-employed.

Since your business does not withhold income or payroll taxes, the contractor is responsible for paying the full amount of tax themselves.

This includes the full self-employment tax. This tax rate is 15.3 percent, which covers both the employer and employee portions of Social Security and Medicare.

Because taxes are not withheld automatically, 1099 contractors must typically make quarterly estimated tax payments to the Internal Revenue Service (IRS) and state agencies, like the Arkansas DFA or the Missouri DOR, to avoid penalties.

While hiring 1099 contractors avoids employer payroll taxes, they often charge higher rates to compensate for their increased tax liability and lack of employee benefits.

Cost Differences and Employer Responsibilities

For growing businesses in Bentonville and Northwest Arkansas, the initial cost of a worker can be misleading. While paying a flat rate to a 1099 independent contractor seems cheaper upfront, you must calculate the total cost of legal compliance and benefits.

The true costs of a W-2 employee often provide long-term stability and protection against costly misclassification penalties.

W-2 Employees: The Full Cost of Compliance

Hiring W-2 employees involves several costs beyond their gross wages. These are essential costs the business absorbs to ensure legal compliance and attract and retain top talent.

For every W-2 employee, the employer has significant employer responsibilities. You must pay half of the FICA taxes (Social Security and Medicare), which currently stands at 7.65 percent of the employee’s wages. These are part of your required payroll taxes.

Beyond taxes, you must also cover unemployment insurance premiums at the state and federal level, as well as workers’ compensation insurance. This coverage is mandatory in Arkansas and protects both the worker and your business in case of injury on the job.

Crucially, W-2 employees are protected by federal labor laws, including minimum wage requirements and overtime regulations. Failing to comply with these rules for a misclassified worker can lead to severe penalties from the Department of Labor (DOL).

The Value of Employee Benefits and Retention

A major component of the cost difference is employee benefits. Offering robust employer provided benefits is a crucial way to attract and retain talent in the competitive NWA market.

Common benefits include health insurance, paid time off, and access to retirement plans like a 401(k) plan. These benefits are a significant part of the total compensation package for W-2 employees.

While these costs increase your budget, they are often offset by higher productivity and reduced turnover, providing a strong return on investment for your business.

1099 Contractors: Shifting the Tax Burden and Higher Rates

When you use a 1099 independent contractor, your business avoids paying payroll taxes, benefits, and insurance costs. You simply pay the agreed-upon rate or flat fee, simplifying your immediate accounting.

However, 1099 contractors often charge significantly higher hourly rates than W-2 employees. They must charge more to compensate for their own expenses, including the full self-employment tax, their own health insurance, and funding their own retirement plans.

This difference in tax implications is critical. The contractor is responsible for paying the entire 15.3 percent FICA taxes. They must also manage their own quarterly estimated tax payments directly to the Internal Revenue Service (IRS).

Control and Autonomy: The Classification Difference

The difference between a 1099 vs W-2 worker fundamentally comes down to the level of control you exert over the worker, which directly impacts legal compliance.

For a W-2 employee, the business dictates the work hours, the methods used, and provides the tools. They operate under high control and are protected by labor laws.

A true 1099 independent contractor maintains high autonomy. They set their own schedules and decide how to complete the project. If you treat a contractor like an employee, you face serious misclassification penalties.

Reducing Risk: Why Businesses Transition to W-2

Many busy NWA business owners find that transitioning their key workers from 1099 status to W-2 employees is necessary for growth and stability.

A common reason is accessing larger clients who demand that their vendors use a compliant W-2 workforce. Furthermore, having engaged W-2 employees allows you to offer premium services and maintain higher quality control.

Reducing the risk of severe misclassification penalties is another primary driver. By ensuring proper worker classification, you minimize legal risk and the hassle of dealing with the IRS or Department of Labor.

Ultimately, W-2 employment provides the necessary structure, talent retention, and legal compliance required for sustainable growth, even if the immediate costs are higher.

Legal Compliance: Why Worker Classification Matters

The legal difference between a W-2 employee and a 1099 independent contractor is the most critical factor for your business.

If the Internal Revenue Service (IRS) or the Department of Labor determines you classified a worker incorrectly, your business could face severe misclassification penalties.

The Core Test: Level of Control

The key factor the government uses to determine worker classification is the level of control you have over the worker.

For W-2 employees, you dictate when, where, and how the work is done. You typically provide the tools and supervision.

In contrast, 1099 contractors have high independence. They set their own schedules, use their own methods, and are generally governed only by the terms of their contract, not day-to-day supervision.

Protection Under Labor Laws

When you hire W-2 employees, you automatically take on specific employer responsibilities under state and federal labor laws.

This includes complying with minimum wage and overtime regulations. Workers are also protected by anti-discrimination laws and statutes like the Family and Medical Leave Act.

Independent contractors (1099 contractors) are not covered by these protections; they are running their own businesses.

High Stakes: Misclassification Penalties

The Internal Revenue Service and the Department of Labor actively pursue businesses in Northwest Arkansas that improperly use 1099 classification simply to avoid payroll taxes and employee benefits.

If you misclassify a worker, the financial consequences can be staggering. This chaos is the exact thing Starner Tax Group (Pea Ridge) helps you avoid.

If caught, your business may be liable for significant misclassification penalties, including:

- Back payroll taxes: You must pay the employer and employee portions of FICA taxes (Social Security and Medicare) that should have been withheld.

- Self-employment tax liability: The IRS often holds the employer responsible for the worker’s full 15.3% self-employment tax portion.

- Interest and Penalties: Fees accrue on all unpaid taxes and required unemployment insurance contributions.

- Workers’ compensation: Fines related to failure to provide required workers’ compensation coverage.

Compliance in Arkansas and Missouri

While some states have adopted very strict criteria, such as the AB5 law (California), Arkansas and Missouri also maintain specific rules for worker classification.

For busy business owners in Bentonville and surrounding NWA communities, prioritizing legal compliance is essential to avoid these financial surprises.

When dealing with multi-state employees, a common reality near the Arkansas/Missouri border, the complexity of state-specific unemployment insurance and workers’ compensation requirements increases the risk.

We recommend a full assessment to ensure your worker classification strategy aligns with the actual level of control you exert over your team.

Why Businesses Transition to a W-2 Workforce

For growing businesses in Northwest Arkansas, the choice between using 1099 contractors and W-2 employees is strategic. While 1099 workers offer initial flexibility, many scaling companies choose the W-2 model for long-term stability.

Even companies known for using gig workers, such as Bluecrew, Wonolo, Qwick, and Zeal, have recognized the long-term value of moving core roles to W-2 employee status to ensure compliance and quality.

Improved Control and Service Quality

One primary advantage of W-2 employees is the high level of control you maintain over their work. Unlike 1099 independent contractors, your business can set schedules, dictate methods, and require specific training.

This ability to provide centralized training and direct supervision leads to consistent service quality. Businesses aiming for premium service, or those scaling rapidly, often find this control essential for achieving their goals.

Attracting and Retaining Talent with Employee Benefits

Shifting to a W-2 model is crucial for improving worker retention. W-2 employees are typically more engaged and invested in the company’s success because they receive employer provided benefits.

Offering comprehensive employee benefits, such as health insurance, paid time off, and retirement plans like 401(k) plans, helps attract top talent in competitive NWA markets like Bentonville and Rogers.

These benefits are generally not provided to 1099 workers, making W-2 status a powerful tool for building a loyal, long-term team.

Reducing Legal and Financial Risks

The most significant long-term benefit of using W-2 employees for core roles is the reduction in legal exposure. This move ensures better legal compliance with federal and state labor laws.

When workers are properly classified, businesses drastically reduce the risk of expensive audits and severe misclassification penalties from the Internal Revenue Service (IRS) or the Department of Labor (DOL).

W-2 classification means your business handles crucial employer responsibilities, including paying required payroll taxes, securing workers’ compensation insurance, and managing unemployment insurance premiums.

By complying with federal rules like minimum wage and overtime regulations, you eliminate many compliance headaches that arise when misclassifying a worker who should be protected by those laws.

Access to Larger Clients and Markets

Many large corporations or government contracts require vendors to use properly classified W-2 employees. Transitioning your workforce can open up new, lucrative revenue streams.

This is especially relevant in regions where the legal landscape around gig work is tightening, such as in states with laws similar to the AB5 law (California), which aggressively redefines who qualifies as an independent contractor.

By ensuring proper worker classification, you signal stability and compliance to potential high-value clients.

Getting the Worker Classification Right: How Starner Tax Group Pea Ridge Helps NWA Businesses

For busy business owners across Northwest Arkansas, from Bentonville and Rogers to Centerton and Bella Vista, dealing with the rules set by the Internal Revenue Service (IRS) and the Department of Labor can feel overwhelming.

The choice between using 1099 independent contractors and W-2 employees is one of the most critical decisions affecting your cash flow and legal standing.

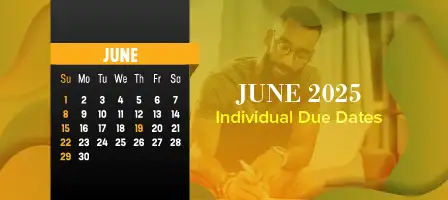

You may be asking: “How do I ensure my payroll taxes are compliant across state lines, especially with staff operating in Arkansas and Southwest Missouri?”

Worker Classification: Tax Implications for 1099 vs W-2

The first major difference between a W-2 employee and a 1099 contractor lies in the financial and tax implications.

For W-2 employees, you, the employer, handle withholding. Federal, state, and local taxes are taken out automatically, simplifying the worker’s tax obligations.

However, when you hire 1099 contractors, they are responsible for paying their own taxes. This includes the full 15.3% self-employment tax, which covers Federal Insurance Contributions Act (FICA) taxes, Social Security and Medicare.

This means 1099 workers must make quarterly estimated tax payments to the IRS to avoid surprises or penalties, a burden W-2 employees typically do not face.

Control, Autonomy, and Legal Compliance

Worker classification is determined less by the contract and more by the relationship, specifically the level of control you exert over the work.

W-2 employees operate under significant control: you set their schedules, provide tools, and supervise their methods. This control triggers specific labor laws, including minimum wage and overtime regulations.

Conversely, 1099 contractors must maintain high independence and autonomy. They set their own hours and determine the methods they use to complete the job, governed primarily by contract terms.

Misclassification penalties can be severe. If the Internal Revenue Service or Department of Labor determines you treated an employee as a 1099 independent contractor, you could owe back payroll taxes, including FICA taxes, unemployment insurance premiums, and other fines.

The Total Cost Difference and Employee Benefits

While paying a 1099 contractor a flat fee might seem cheaper upfront, the true costs to business are complex.

For W-2 employees, you must pay your share of payroll taxes (FICA taxes) and provide workers’ compensation insurance and unemployment insurance.

Furthermore, W-2 employees typically receive employer provided benefits essential for talent retention, such as health insurance, paid time off, and retirement plans, like a 401(k) plan.

1099 contractors cover their own expenses, but they often charge higher rates to compensate for the self-employment tax and lack of employee benefits.

Transitioning to W-2 Employees: Reducing Risk and Scaling Growth

Many growing Northwest Arkansas businesses, especially those scaling rapidly like Bluecrew, Wonolo, Qwick, and Zeal have recognized, choose to transition core roles to W-2 status.

Key reasons include access to larger clients who demand W-2 workers and attracting top talent who prioritize employee benefits.

Reducing legal compliance risk is also critical. Ensuring compliance with stricter labor laws reduces the possibility of costly misclassification penalties.

Starner Tax Group (Pea Ridge) helps you with the assessment and risk analysis necessary before making this major transition.

Proactive Tax Planning and Payroll Services with Starner Tax Group Pea Ridge

At Starner Tax Group (Pea Ridge), we offer a low-pressure, informed guidance approach focused on proactive tax planning.

We work with you to determine the correct worker classification, ensuring you meet all federal and state requirements, minimizing the chance of an unexpected notice.

If you are scaling your team, our full-service offering ensures your payroll services are handled correctly. We manage state withholding and reporting for Arkansas and Missouri, preventing the chaos of “set-and-forget payroll.”

Our goal is simple: to save you time, money, and stress by providing accurate documentation and filing, leading to fewer surprises at tax time.

Worker Classification FAQs: Costs, Compliance, and Tax Implications

What happens if I misclassify a W-2 employee as a 1099 independent contractor?

If the Internal Revenue Service (IRS) or the Department of Labor determines you have misclassified a worker, your business faces significant consequences.

You may be required to pay back all unpaid payroll taxes, including your share of FICA taxes (Social Security and Medicare), plus interest and fines. These misclassification penalties undermine your financial stability and legal compliance, which is a major concern for growing businesses in NWA.

Do I have to offer employee benefits to 1099 independent contractors?

No. By definition, 1099 independent contractors are self-employed. They manage their own business expenses, including their own health insurance, paid time off, and contributions to retirement plans like a 401(k) plan.

Your business is only required to provide these employer provided benefits to W-2 employees. This difference is a core component of the different costs to business associated with each worker type.

How do I know if I have too much “level of control” over a contractor?

The IRS focuses on the degree of control you exercise over the worker. A high level of control means you dictate the tools, the schedule, and the specific methods used to complete the work.

If you require a worker to attend mandatory meetings, work set hours, or use company-specific equipment, they likely must be treated as a W-2 employee. If they have high independence, setting their own schedule and using their own equipment, they are likely a 1099 independent contractor.

What are the key tax implications for 1099 contractors?

Unlike W-2 employees, who have federal, state, and local taxes withheld automatically, 1099 independent contractors are responsible for their entire tax burden.

This includes the full 15.3% self-employment tax (covering Social Security and Medicare). Because nothing is withheld, they must make quarterly estimated tax payments to the IRS and state agencies to avoid penalties.

How do the costs of 1099 contractors and W-2 employees differ for my business?

While paying a 1099 independent contractor often seems cheaper upfront, the cost structures are very different and impact your overall tax implications.

For W-2 employees, the business pays payroll taxes, half of the FICA taxes, workers’ compensation insurance, and unemployment insurance premiums. Plus, you cover the cost of employee benefits like health insurance and paid time off.

For 1099 contractors, you pay a flat fee, but they typically charge a higher rate to cover their own self-employment tax and expenses. Understanding these true costs to business is vital for cash flow planning in Bentonville and Rogers.

Why would a growing NWA business choose to transition contractors to W-2 employees?

Many busy, scaling businesses realize that W-2 employees offer greater reliability and reduced legal risk compared to 1099 contractors.

Transitioning helps ensure legal compliance with federal and state labor laws, including minimum wage and overtime regulations. W-2 status also helps businesses attract and retain top talent by offering competitive employee benefits and stability.

Can Starner Tax Group (Pea Ridge) help if I receive an IRS notice about worker classification?

Yes. Handling IRS notices about worker classification is a core part of our service.

We specialize in tax resolution and IRS representation, providing low-pressure, informed guidance. If you receive a letter, we assess the situation, respond to the Internal Revenue Service on your behalf, and help negotiate options to bring you back into legal compliance.

Early action matters. Don’t let unanswered notices escalate into greater stress and penalties.

Strategic Differences: Why Proper Worker Classification Matters

Do not let the complexity of worker classification hold back your growing business in Northwest Arkansas. Understanding the differences between 1099 contractors and W-2 employees is crucial for managing risk and planning for success.

Understanding the True Tax Implications for 1099 vs W-2

For W-2 employees, managing taxes is straightforward. Federal, state, and local taxes are automatically withheld from every paycheck. This simplifies tax obligations for the employee.

The situation is very different for 1099 independent contractors. They are considered self-employed and must handle their own taxes. This means they are responsible for the full 15.3% self-employment tax, which covers both the employer and employee portions of Federal Insurance Contributions Act (FICA) taxes (Social Security and Medicare).

Since no money is withheld, 1099 contractors must make quarterly estimated tax payments directly to the Internal Revenue Service (IRS) and state agencies. Failure to do so can result in penalties for the contractor.

Control and Autonomy Over Workers

The core difference in classification comes down to the level of control you exert. W-2 employees operate under significant control. Businesses typically dictate their set work hours, provide the necessary tools, and supervise the methods used to perform the job.

In contrast, 1099 contractors must maintain high independence and autonomy. They set their own schedules, use their own equipment, and decide how they will complete the job. If you dictate the “how” and “when” for a contractor, you risk serious misclassification penalties under the law.

The Cost of Employee Benefits and Talent Retention

A major financial distinction lies in employee benefits. W-2 employees typically receive employer provided benefits such as health insurance, paid time off, and access to retirement plans like a 401(k) plan. These benefits are essential tools for attracting and retaining top talent in competitive NWA markets like Rogers and Bentonville.

1099 contractors are responsible for covering all their own expenses. They do not receive paid time off or company-sponsored health insurance from the hiring business. This difference is a significant factor in calculating the overall costs to business for each classification.

Analyzing the Full Cost Differences for Businesses

Many business owners focus only on the immediate paycheck cost. For W-2 employees, employers must pay payroll taxes, cover a portion of the Federal Insurance Contributions Act (FICA) taxes, and provide workers’ compensation insurance and unemployment insurance premiums.

When you hire a 1099 contractor, you avoid those employer taxes and benefits costs. However, 1099 contractors often charge a higher hourly or project rate than an equivalent W-2 worker. This higher rate is necessary for them to cover their own expenses and that 15.3% self-employment tax.

Navigating Legal Compliance and Labor Laws

Legal compliance is a non-negotiable part of running a business. W-2 employees are protected by strict labor laws, including minimum wage requirements and overtime regulations. Laws enforced by the Department of Labor (DOL), such as the Family and Medical Leave Act (FMLA), apply to many W-2 workers.

1099 contractors are governed purely by the terms of their contract. Failing to adhere to proper worker classification rules exposes your business to huge misclassification penalties. Even though we are far from California, strict regulatory efforts like the AB5 Law (California) show how seriously the government takes this issue.

When to Transition to a W-2 Workforce

Many busy, scaling businesses in Northwest Arkansas eventually find compelling reasons to shift some roles from 1099 contractors to W-2 employees. This transition stabilizes the workforce and significantly reduces long-term legal compliance risks.

Transitioning allows a business to offer premium services with more engaged workers, as W-2 status generally improves worker retention. While the immediate payroll taxes are higher, the long-term benefits include reduced liability and better control over quality and training. This can lead to increased revenue streams through higher billing rates.

Companies like Bluecrew, Wonolo, and Qwick often work with businesses to manage the transition from flexible 1099 staffing models to compliant W-2 employment models, highlighting the growing complexity of the gig economy.

Ready to Simplify Worker Classification?

If you are a business owner in Bentonville, Rogers, or the surrounding Northwest Arkansas area, you are busy. You should not have to spend time worrying about whether your 1099 vs W-2 structure is compliant with the Internal Revenue Service.

Starner Tax Group (Pea Ridge) is local to you, serving all core NWA markets and Southwest Missouri up to Cassville, MO. We provide full-service tax preparation and proactive tax planning with a personalized, low-pressure approach.

We help you navigate complex issues like estimated tax payments and defining your employer responsibilities. If you have received an IRS letter about payroll taxes or worker classification, we specialize in IRS representation to assess the situation and plan a clear path forward.

Let us take care of everything, from assessing your classification risks to accurate filing, so you can save time, money, and stress, and focus on running your thriving NWA business.

Contact Starner Tax Group (Pea Ridge) today:

- Call: 479-451-1040

- Address: 185 S Curtis Ave, Pea Ridge, AR 72751

- Use our secure Client Portal to upload your files and start the conversation.