TL;DR

- Foundation & Identity: Ensure all personal information (SSN/ITIN, current address, bank account/routing numbers for Direct Deposit) is accurate, and have your previous year’s Adjusted Gross Income (AGI) ready to verify identity and prevent e-filing delays.

- Income Documentation: Collect all sources of income, including Form W-2 (wages), the full 1099 series (1099-NEC for contractors, 1099-K for payment apps), and records for investments or Digital Asset Transactions (cryptocurrency).

- Maximize Deductions: Gather meticulous supporting records (e.g., Form 1098 for mortgage interest, charitable receipts, medical bills, business expense logs) to itemize deductions and claim crucial credits (like the Premium Tax Credit).

- Self-Employment Prep: Small business owners must track all business expenses, mileage logs, and documentation proving quarterly estimated tax payments to accurately calculate tax liability and avoid penalties.

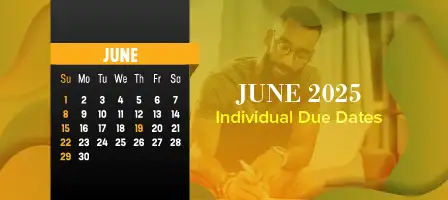

Your Ultimate Tax Prep Checklist for 2026

Before we even look at income, we need to make sure the Internal Revenue Service (IRS) knows exactly who you are and where to send your money! This section is all about gathering documents that confirm your identity and ensure correct processing.

Why Getting Organized Now Saves You Stress Later

Tax season does not have to be a massive headache, truly. I know, having to gather documents feels like a monumental chore, but trust me, getting organized early is the single best way to minimize stress and maximize your potential refund.

When you come prepared to Starner Tax Group, we can spend our time focusing on proactive tax planning and finding every single credit and deduction you deserve, instead of scrambling for missing paperwork or chasing down missing IRS forms.

Did you know that having all your accurate personal information ready ensures your refund amount is processed correctly and quickly? Delays usually happen because of simple missing details during the tax filing process!

Step One: Get Your Personal Information in Order

The foundation of filing your taxes correctly starts with identity. You will need valid personal information for everyone listed on your tax return. This includes your Social Security number (SSN) or, if applicable, your individual tax ID (ITIN).

It is critical that these details match the records held by the Internal Revenue Service (IRS) and the Social Security Administration (SSA). Remember, accurate personal information is absolutely key to ensuring correct processing and maximizing your claim of deductions.

And speaking of your money, if you want to get your refund quickly via direct deposit, you must have your current bank account and routing numbers ready. If you recently had a name change or need to change address, make sure you notify the SSA before you file your taxes!

Do Not Toss Last Year’s Tax Return Details

If you are planning to e-file your taxes this year, you absolutely need documentation from your last year’s return. Why? The IRS uses key data points from your previous filing to verify your identity.

Specifically, knowing your last year’s adjusted gross income (AGI) is crucial for identity verification and often required if you use a self-select PIN for electronic signing. Studies show that having last year’s return details readily available significantly reduces processing delays!

Even if you filed with us previously, it is smart to have a copy of last year’s return handy so we can quickly verify your data and ensure we are not missing any carryovers that could affect your current tax return.

Ready to Gather Your Financial Forms?

Now that we have locked down your identity and prior year data, it is time to look at the money coming in and the money going out. This comprehensive checklist covers everything you need to file your taxes, whether you are just an individual or managing a bustling small business.

We will walk through all the essential IRS forms you need to collect to ensure we maximize your potential refund and minimize the amount you pay taxes on.

Step 1: Your Personal Foundation, The Must-Have Details

You absolutely must have current, accurate personal information for everyone listed on your tax return. This means gathering documents showing the legal name, date of birth, and, most importantly, the Social Security number (SSN) for yourself, your spouse, and any dependents.

Step 2: Show Me the Money! Collecting All Your Income Documentation

For our freelancers, independent contractors, and small business owners, you will be dealing with the crucial 1099 series of IRS forms. This self-employment and side income documentation is key to minimizing your tax bill.

Step 3: Finding the Tax Breaks (Deductions and Credits)

But wait, if you are a small business owner, a freelancer, or have significant side income, your deduction documentation is even more important! You will need records to reduce your Adjusted Gross Income (AGI). Make sure to collect all income reports that apply to you, such as Form W-2s for wages, Form 1099s for various types of income.

The Small Business and Self-Employment Checklist

If you are a dedicated freelancer, a side-hustle superstar, or a small business owner, your tax life gets a little more complex. You are basically running a mini-corporation! That means your list of necessary tax documents is significantly longer.

The golden rule here is simple: you absolutely must separate your personal spending from your business spending. If you want to claim valuable credits and deductions, we need crystal-clear proof of your business income and expenses.

Tracking Business Income and Expenses

As a self-employed individual, you will be gathering Form 1099-NEC (Nonemployee Compensation) from clients who paid you over $600. Remember, that only covers the money they reported paying you. You still need proof of all your other business income!

To really lower your taxable income and reduce what you pay taxes on, we need accurate records of every nickel you spent running your business. This is where those meticulous records come into play.

- Bank and Payment Statements: Gather statements from all accounts, business checking, credit cards, and payment apps like Spruce. We need to clearly see your gross revenue and operating costs.

- Expense Logs and Receipts: Did you buy supplies? Pay for advertising? Purchase equipment? You must have detailed receipts and records for all business expenses, proving the purpose of the purchase.

- Mileage Logs: If you use your vehicle for work, a detailed mileage log is vital. It must show the date, destination, and the specific business purpose for the trip to qualify for that deduction.

Do Not Forget Your Estimated Tax Payments

When you are self-employed, the Internal Revenue Service (IRS) expects you to pay taxes throughout the year. Did you remember to make those quarterly estimated tax payments? Most self-employed folks need to file these four times a year!

It is absolutely crucial that you gather documents showing proof of all four payments you sent to both the IRS and your state. If we do not have these records, you could face unexpected penalties for underpayment, and no one wants that surprise when they finally file your taxes.

The Final Lap: What You Need to File Your Taxes and Get Your Refund

You have gathered all your income statements and tracked those business expenses. Awesome! Now we move into the final administrative steps to successfully file your taxes for 2026.

To make sure your tax return is accepted by the Internal Revenue Service (IRS) and that you get your refund quickly, we need to gather a few critical pieces of personal information and documentation from last year.

Step 1: Confirming Your Personal Information and Identity

This might seem obvious, but accurate personal information is the foundation of a correct tax filing. You absolutely must have the correct Social Security number (SSN) for yourself, your spouse, and any dependents you plan to claim.

If you do not have an SSN, make sure you have your correct Individual Taxpayer Identification Number (ITIN). Accurate personal info ensures the correct processing of your refund amount and allows us to claim every deduction possible.

Step 2: Finding Last Year’s Tax Return Details

Did you know that having your previous year’s tax return details can actually speed things up? When you e-filed your taxes, the IRS often requires you to verify your identity using specific data points.

The most important detail we need is your Adjusted Gross Income (AGI) from last year. Having this information, along with any Identity Protection PIN (IP PIN) you might have, significantly reduces processing delays and helps us successfully submit your tax filing.

Step 3: Documenting Your Deductions and Credits

We work hard to help you maximize your savings, but claiming those valuable credits and deductions requires documentation. If you plan on itemizing deductions instead of the standard deduction, you need proof!

This includes supporting records for mortgage interest (like Form 1098), charitable donations, medical expenses, and education costs. Remember, supporting records are critical; studies show that itemizing deductions can save clients an average of up to 30% to 50% compared to just taking the standard deduction alone.

Step 4: Ensuring You Have All Income Forms

Whether you are an employee or a self-employment superstar, you must gather documents for every single source of income. This means collecting all your Form W-2 (Wage and Tax Statement) and any applicable 1099 series forms, like 1099-INT for interest or 1099-DIV for dividends.

If you are a gig worker or freelancer, make sure you have all your Form 1099-NEC (Nonemployee Compensation) statements, as well as statements from banks or payment apps like Form 1099-K. And do not forget documentation related to Digital Asset Transactions, if you have those!

Step 5: How to Get Your Refund Fast

Once we have successfully e-filed your tax return, you want your money, right? If you want to get your refund quickly, direct deposit is absolutely the fastest way to go.

To use Direct Deposit of Refund, you must provide accurate bank account information, including the bank’s routing numbers and your specific bank account number. Just confirm those numbers twice! A mistake could send your refund amount to the wrong place, and nobody wants that.

A Quick Look at Key IRS Forms

To help you keep track of all those critical tax documents, here is a quick comparison table of the most common IRS forms you might need. Remember, you might have documents from multiple sections!

| Document Type | Primary Form | Who Needs It? | Purpose |

|---|---|---|---|

| Wages/Salary | Form W-2 (Wage and Tax Statement) | Employees | Reports income and withholdings. |

| Contractor Income | Form 1099-NEC (Nonemployee Compensation) | Self-Employed, Freelancers | Reports nonemployee compensation. |

| Health Coverage (Marketplace) | Form 1095-A (Health Insurance Marketplace Statement) | Marketplace Enrollees | Required to reconcile the Premium Tax Credit. |

| Payment App Transactions | Form 1099-K | Gig Workers, Small Businesses | Reports payment card and third party network transactions. |

| Interest/Dividends | Forms 1099-INT/DIV | Investors | Reports taxable interest and dividend income. |

| Mortgage Interest Paid | Form 1098 | Homeowners | Required for itemizing deductions. |

Remember, gathering these documents is the biggest hurdle. Once you have everything organized, filing your tax return is easy. Ready to start?

Do Not Wait, Start Gathering Now!

It is January 31, 2026, and tax filing season is officially here! You cannot file your taxes until you have those critical tax documents in hand, right?

The biggest mistake we see clients make is waiting until the last minute to gather documents. When you rush, you are much more likely to forget crucial credits and deductions or miss a necessary IRS form. Do not let that happen to you!

Proactive preparation is not just about avoiding stress; it is about ensuring accuracy. To successfully e-file your current tax return and verify your identity, you need specific information from last year’s return.

The Internal Revenue Service (IRS) often requires your Adjusted Gross Income (AGI) from the previous year. Having this crucial data handy helps confirm who you are and speeds up the entire process, sometimes even allowing you to use a self-select PIN for quick filing!

And speaking of verification, double-check all your personal information. We need accurate Social Security number (SSN) details for everyone on the return, or the Individual Taxpayer Identification Number (ITIN) if applicable.

Accurate personal info ensures correct processing and helps you claim those valuable deductions. Plus, if you want to get your refund fast, make sure you have your current bank account and routing numbers ready for Direct Deposit of Refund.

We specialize in helping individuals and small businesses across Northwest Arkansas and Southwest Missouri feel confident about their taxes. We want to build a long-term relationship based on trust, minimizing your stress and maximizing your refund amount!

Give us a call at Starner Tax Group Pea Ridge. Let us get your checklist sorted out now so we can handle your tax filing without a hitch!

Keeping Your Filing Stress-Free: Quick FAQ

What is my Adjusted Gross Income (AGI) and why do I need details from my last year’s return?

Your Adjusted Gross Income (AGI) is essentially your gross income minus specific adjustments. Why does the Internal Revenue Service (IRS) care about your AGI from your last year’s return? Well, if you are going to e-file your tax return or set up a self-select PIN, they use that number as a critical security measure.

Having that accurate AGI helps verify your identity, preventing delays and ensuring you get your refund via direct deposit faster. Studies show that having this info ready reduces processing delays significantly!

Why is gathering personal information so critical for tax filing?

This might seem obvious, but accurate personal information is the foundation of your entire tax return. You absolutely must have the correct Social Security number (SSN) or Individual Tax ID (ITIN) for yourself, your spouse, and any dependents you claim.

And speaking of refunds, if you want that money fast, you need your current bank account and routing numbers ready for direct deposit. Accurate personal information ensures correct refund processing and allows us to claim all your deserved credits and deductions.

What if I have not received all my W-2 or 1099 forms yet?

We know waiting for tax documents can be frustrating! Most employers and financial institutions are required to send out Form W-2 (Wage and Tax Statement) and the various IRS forms in the 1099 series by January 31st.

If you have not received yours, check your mail and email spam folders first. Then, reach out to the payer immediately. Remember, you cannot accurately file your taxes or report your total income without these critical tax documents like Form 1099-NEC or Form 1099-K.

Do I really need to document every single deductible expense?

Yes, absolutely! If you are planning on itemizing deductions, instead of just taking the standard deduction, you must have detailed documentation. This includes records for things like mortgage interest, charitable donations, medical expenses, and even education costs.

Supporting records are critical when itemizing deductions, and historically, this process can save taxpayers an average of up to 30-50% compared to standard filing. Accurate documentation is key to maximizing your credits and deductions.

I’m a small business owner. What records do I need for my self-employment income?

As a small business owner or freelancer using Form 1099-NEC, detailed documentation is your best friend. The Internal Revenue Service (IRS) requires proof for all business expenses you claim to offset your income.

This means keeping clear bank statements, payment app records, mileage logs, and receipts for every expense. Accurate documentation of business income and expenses is vital to minimize your tax liability and avoid penalties when you pay taxes.

What are Estimated Tax Payments and do I need to include them?

If you are a sole proprietor or have significant side income, you might make estimated tax payments quarterly. These are payments made throughout the year if you expect to owe at least $1,000 in taxes when you file your taxes.

If you made these payments, you must bring us records of the dates and amounts paid. We need to ensure you receive full credit for them, otherwise, the IRS might hit you with an underpayment penalty.

Do not forget to include records for any Premium Tax Credit payments or details regarding Digital Asset Transactions you made throughout the year!