Receiving a letter or notice from the IRS can understandably feel overwhelming and confusing. Whether it’s about a tax return adjustment, a notification of unpaid taxes, or a request for more information, this correspondence is an official communication from the Internal Revenue Service concerning your federal tax situation.

It is essential not to ignore these letters, as they often contain important details about your tax return, refunds, payments owed, or potential audits. The IRS sends these letters to taxpayers for various reasons, including to inform about changes in your tax return, to notify you of a balance due, or to verify your identity.

Understanding what the letter means and how to respond can help you avoid penalties, resolve issues efficiently, and protect your rights as a taxpayer. If you’ve just received an IRS letter, stay calm and prepared to take the necessary steps, whether that involves making a payment, providing additional documentation, or seeking assistance from a tax professional or services like TurboTax. This article will guide you through what to do next when the IRS contacts you, helping you navigate this process with confidence and clarity.

Understanding Your IRS Letter

Identify the Type of Letter or Notice

When you receive an IRS letter, it is essential to identify the type of notice you are dealing with. The IRS uses specific codes for different types of notices, such as CP501 for a balance due, CP2000 for proposed adjustments based on income discrepancies, and CP90 for intent to levy assets. Each notice type has distinct implications and requirements for response.

For instance, a CP2000 notice might indicate a discrepancy between your reported income and the income reported to the IRS by third parties, while a CP501 notice directly informs you of an outstanding balance. Understanding the notice type will help you determine the necessary steps to take.

Determine What the IRS is Requesting or Informing You About

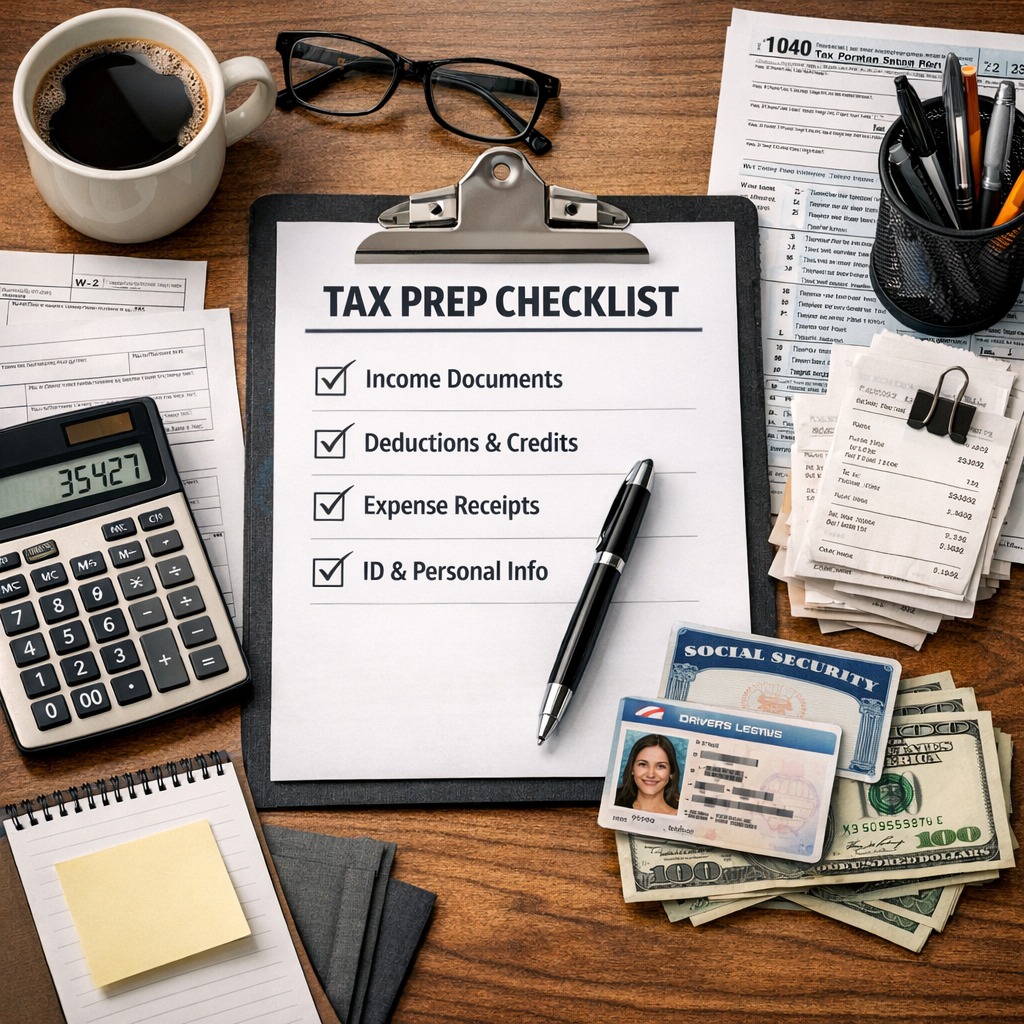

Once you have identified the type of notice, carefully read through the letter to understand what the IRS is requesting or informing you about. The notice may request additional information, notify you of a payment due, or inform you of a proposed adjustment to your tax return.

Some notices, like those related to the Earned Income Tax Credit (EITC) or Child Tax Credit, may require you to provide documentation to support your eligibility for these credits. Others might inform you of a refund or a change in your tax situation, such as an audit or a federal tax lien. It is important to carefully review the notice to ensure you comply with the IRS’s requests and avoid any further action or penalties.

How to Respond to the IRS Letter

If You Agree with the Notice

If you agree with the information in the IRS notice, follow the instructions provided. This might involve paying any additional taxes due, making sure to use the reference number on your payment for proper processing. If there are corrections to your tax return, update your personal records accordingly.

In most cases, you do not need to send a reply unless the notice specifically asks you to do so. Ensure you keep a copy of the notice and any related documentation for your records. Additionally, if you have been informed of a refund adjustment, confirm the changes align with your understanding of your tax return.

If you need to make a payment, consider using the IRS’s online payment tools to expedite the process and avoid further communication.

If You Disagree

If you disagree with the contents of the IRS notice, respond promptly by following the instructions provided in the notice. This usually involves drafting a written explanation and including copies of relevant documents that support your position.

It is essential to keep a copy of your response for your records. Ensure that you send your response by the deadline specified in the notice to preserve your appeal rights. If the issue is complex or you are unsure about how to proceed, consider consulting a tax professional who can guide you through the process and ensure that your rights are protected.

Dealing with Payments and Charges

If You Have an Amount Due

If your IRS letter indicates that you have an amount due, it’s important to address it promptly to avoid additional penalties and interest. The IRS provides several options to pay your balance, including full payment or entering into a payment plan.

You can pay directly through IRS Direct Pay, which allows you to transfer funds securely from your bank account without fees. It’s also essential to use the payment voucher or reference number provided in the letter to ensure your payment is correctly applied to your tax account.

Ignoring an amount due can lead to escalated collection efforts such as notices of intent to levy or federal tax liens, so taking action quickly is beneficial.

Setting Up Payment Plans or Discussing Further Options

If you cannot pay the full amount owed immediately, the IRS offers accessible payment plan options for most taxpayers. You may qualify for a Simple Payment Plan, which allows you to pay your balance over time, either through a short-term plan (up to 180 days) or a long-term installment agreement lasting up to 10 years.

Setting up a payment plan is easiest through the IRS Online Account portal, where you can apply without calling, mailing, or visiting the IRS. Automatic monthly payments can be arranged via direct debit, which helps reduce setup fees and prevents missed payments.

If you owe more than these thresholds or do not qualify for these plans, other options such as an Offer in Compromise or a temporary delay of collection might be available depending on your financial situation. Contacting the IRS promptly using the contact information in your letter will help you explore the best payment arrangement for your circumstances and avoid escalating enforcement actions.

Conclusion

Receiving an IRS letter can be daunting, but with the right guidance, you can navigate the process with confidence. Remember to identify the notice type, understand what the IRS is requesting, and respond accordingly. If you need to make payments, consider setting up a payment plan to avoid penalties.

Don’t let tax complexities stress you out; secure your finances with confidence. At Starner Tax Group, experienced professionals offer personalized tax solutions for individuals and businesses.

Schedule a consultation today to simplify tax compliance and protect your financial future while keeping more money in your pocket all year long.

FAQ

What types of IRS letters might I receive, and what do they generally mean?

Common IRS letters include:

- CP2000 : Proposed adjustment due to income discrepancy.

- CP501 : Balance due notification.

- CP503 : Reminder for unpaid balance.

- CP90/CP297 : Levy notice for unpaid taxes.

- LTR3172 : Notice of federal tax lien.

What information should I carefully review in the IRS letter I received?

Carefully review the reason for the letter, any requested actions, the due date for response, and any changes or corrections to your tax return. Also, check for a CP or LTR number and ensure the letter is legitimate by contacting the IRS if necessary .

Do I always need to respond to an IRS notice, or are some letters just for my information?

You do not always need to respond to an IRS notice. Respond only if the notice specifically asks for action or payment, or if you disagree with its content.

Otherwise, keep it for your records as it may just be for your information .

What steps should I take if I disagree with the IRS letter or notice?

If you disagree with an IRS letter, first carefully review it and do not ignore it. Respond promptly with a detailed, factual, and professional letter or Form 12203, including your name, contact info, tax period, contested items, reasons for disagreement, and supporting documents.

Avoid signing the IRS report. If unresolved, consider an appeal or Fast Track Settlement.

Follow all IRS instructions and deadlines to prevent penalties.